Let's face it, nurses work tirelessly to save lives, but many are struggling with debt. The debt-free nurse movement has taken the healthcare world by storm, offering practical strategies to help nurses achieve financial independence. In this article, we'll dive deep into the debt-free nurse reviews, uncovering what makes this approach so powerful and how you can benefit from it.

Nursing is one of the most rewarding professions out there, but it comes with its own set of challenges. From student loans to everyday expenses, nurses often find themselves trapped in a cycle of debt. The debt-free nurse concept aims to break this cycle by providing actionable advice tailored specifically for nurses. We'll explore how this movement is changing lives and why it's worth considering.

Whether you're just starting your nursing career or have been in the field for years, financial freedom should be a priority. This guide will walk you through the ins and outs of the debt-free nurse lifestyle, offering tips, strategies, and real-life success stories. So, buckle up and let's get started!

Read also:Unveiling The Charismatic World Of James Darren Evy Norlund

What is the Debt-Free Nurse Movement?

The debt-free nurse movement is more than just a trend; it's a lifestyle change designed to help nurses take control of their finances. At its core, this movement encourages nurses to prioritize paying off debt while building a solid financial foundation. Unlike generic financial advice, the debt-free nurse approach considers the unique challenges faced by nurses, such as long working hours, shift work, and student loan burdens.

One of the key principles of the debt-free nurse movement is the snowball method, where you start by paying off the smallest debt first. This creates momentum and motivation to tackle larger debts. Another popular strategy is the avalanche method, which focuses on paying off high-interest debts first. Both methods have proven effective, and the choice depends on your personal preference and financial situation.

Why Should Nurses Care About Debt-Free Living?

Nurses are natural problem-solvers, and this mindset can be applied to personal finance. By adopting a debt-free lifestyle, nurses can reduce stress, improve their quality of life, and even enhance their job performance. Imagine waking up every day without the weight of debt hanging over your head. Sounds pretty amazing, right?

Here are some reasons why nurses should consider the debt-free nurse approach:

- Reduces financial stress and improves mental health

- Empowers nurses to pursue career goals without financial constraints

- Creates opportunities for travel, education, and personal growth

- Encourages smart financial habits that last a lifetime

Top Debt-Free Nurse Strategies

Now that we've covered the basics, let's dive into some of the most effective strategies used by debt-free nurses. These tactics have been tried and tested by nurses across the globe, proving that financial freedom is achievable with the right mindset and approach.

1. Create a Realistic Budget

Budgeting is the cornerstone of any successful financial plan. As a nurse, your income may fluctuate due to shift work or overtime, so it's essential to create a flexible budget that adapts to your changing circumstances. Start by tracking your expenses for a month to identify areas where you can cut back. Then, allocate a specific amount for each category, such as housing, groceries, and entertainment.

Read also:Seung Yong Chung Diane Farr The Untold Story Of Friendship And Collaboration

Pro tip: Use budgeting apps like Mint or YNAB to streamline the process and stay on top of your finances.

2. Increase Your Income

Let's be honest; sometimes cutting expenses isn't enough. If you're serious about becoming debt-free, consider finding ways to increase your income. Many nurses take on per diem shifts, travel nursing assignments, or side hustles to boost their earnings. The key is to find opportunities that align with your skills and interests without compromising your well-being.

Debt-Free Nurse Reviews: What Are People Saying?

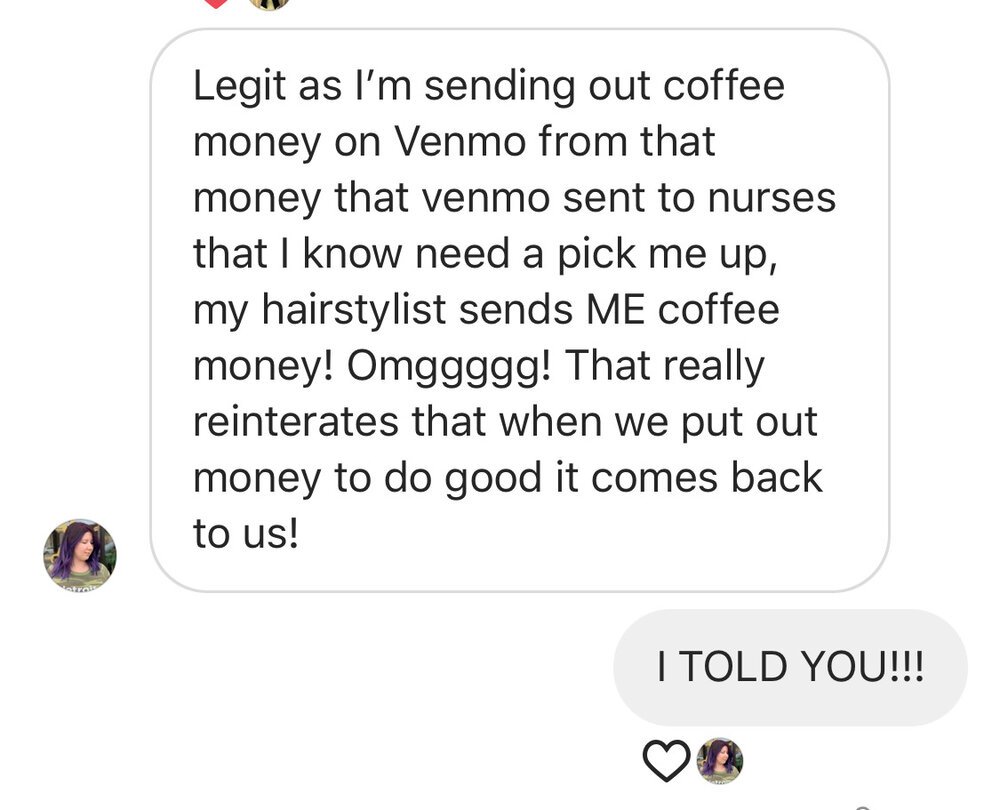

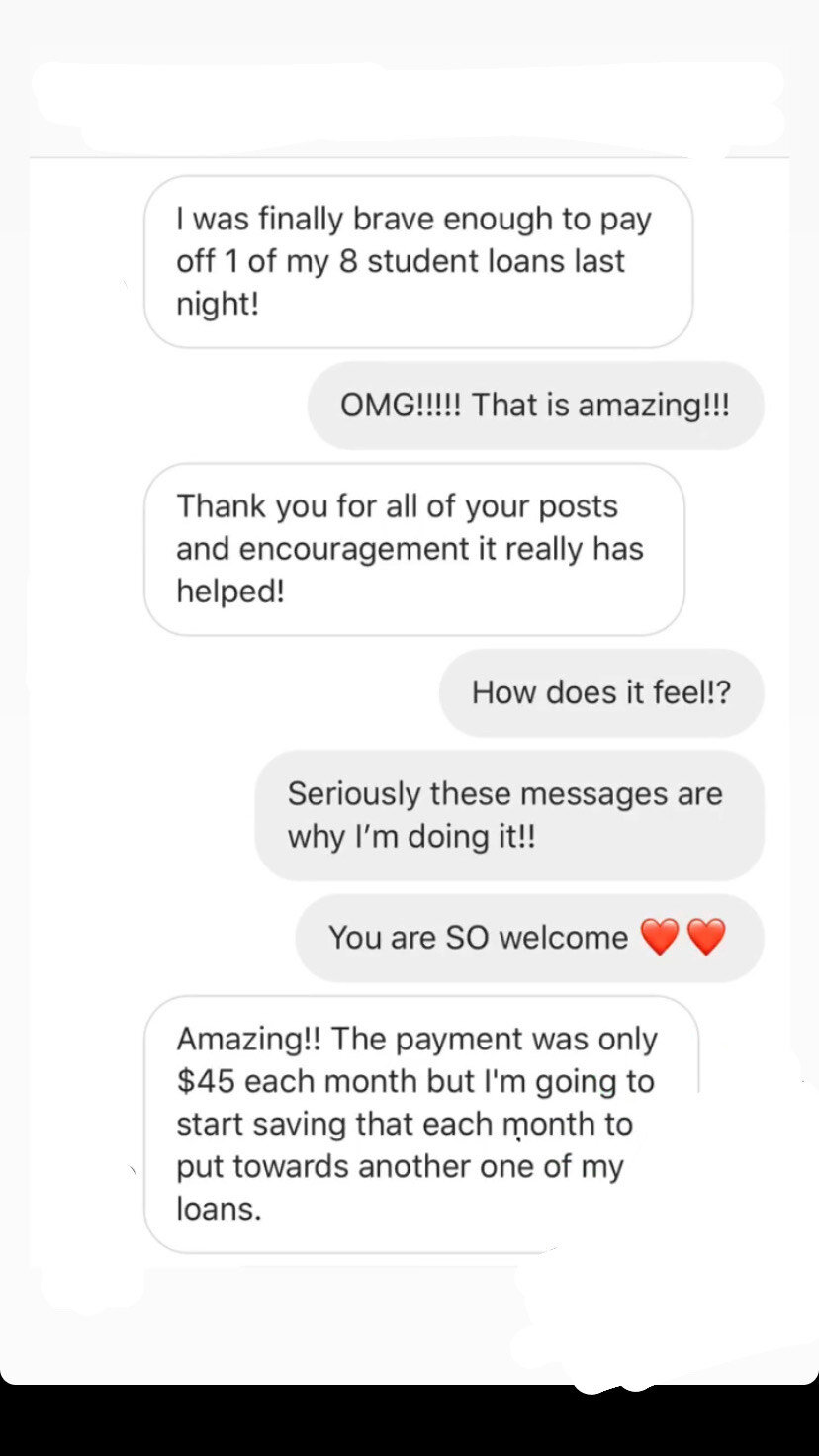

One of the best ways to gauge the effectiveness of the debt-free nurse movement is by reading reviews from real nurses who have implemented these strategies. Countless success stories highlight the transformative impact of this approach on their lives. From paying off student loans to saving for retirement, the debt-free nurse movement has helped countless individuals achieve their financial goals.

Here are a few testimonials from nurses who have embraced the debt-free lifestyle:

- "I paid off $50,000 in student loans in just two years by following the debt-free nurse principles. It wasn't easy, but the sense of freedom is priceless!"

- "As a single mom and nurse, I never thought financial independence was possible. The debt-free nurse movement gave me the tools and confidence to take control of my finances."

Common Challenges Faced by Nurses

While the debt-free nurse movement offers incredible benefits, it's not without its challenges. Some common obstacles nurses face include:

- Managing irregular work schedules

- Dealing with unexpected expenses

- Navigating the complexities of student loan repayment plans

The good news is that these challenges can be overcome with the right resources and support system. Many debt-free nurse communities offer guidance and encouragement to help members stay on track.

Debt-Free Nurse Resources and Tools

There's no shortage of resources available to help nurses achieve financial freedom. From books and podcasts to online courses and support groups, the debt-free nurse community offers a wealth of knowledge and inspiration. Here are some of our top recommendations:

1. Books

Reading is one of the best ways to expand your financial knowledge. Some popular books among debt-free nurses include:

- "The Total Money Makeover" by Dave Ramsey

- "Your Money or Your Life" by Vicki Robin and Joe Dominguez

- "The Simple Path to Wealth" by JL Collins

2. Podcasts

Podcasts are a convenient way to learn while you're on the go. Some must-listen podcasts for debt-free nurses include:

- The Dave Ramsey Show

- The Financial Nurse Podcast

- The Minimalists Podcast

Debt-Free Nurse Lifestyle: Tips for Success

Adopting a debt-free lifestyle requires commitment and discipline, but the rewards are well worth the effort. Here are some practical tips to help you succeed:

1. Set Clear Goals

Having a clear vision of what you want to achieve is crucial for staying motivated. Whether your goal is to pay off debt, save for a vacation, or build an emergency fund, make sure it's specific, measurable, and time-bound.

2. Stay Accountable

Accountability is key to staying on track with your financial goals. Consider finding an accountability partner or joining a debt-free nurse community to share your progress and celebrate milestones.

Debt-Free Nurse vs. Traditional Financial Advice

While traditional financial advice can be helpful, the debt-free nurse movement takes a more personalized approach. By addressing the unique challenges faced by nurses, this movement offers tailored solutions that resonate with its audience. For example, traditional advice might suggest investing in the stock market, but a debt-free nurse might prioritize paying off high-interest credit card debt first.

Key Differences

Here are some of the main differences between debt-free nurse advice and traditional financial advice:

- Focus on eliminating debt vs. building wealth

- Tailored strategies for nurses vs. generic advice

- Emphasis on simplicity and practicality vs. complex financial products

How to Get Started with the Debt-Free Nurse Movement

If you're ready to take the first step toward financial freedom, here's a simple roadmap to get you started:

1. Assess Your Current Financial Situation

Take a close look at your income, expenses, and debts to get a clear picture of where you stand financially. This will help you identify areas for improvement and set realistic goals.

2. Choose a Debt Repayment Strategy

Decide whether the snowball method or avalanche method works best for you and start chipping away at your debt.

3. Build an Emergency Fund

Having a safety net in place is essential for avoiding future debt. Aim to save at least three to six months' worth of expenses in an easily accessible account.

Conclusion: Take Control of Your Financial Future

The debt-free nurse movement offers a powerful solution for nurses looking to break free from the cycle of debt. By implementing the strategies and tips outlined in this guide, you can take control of your financial future and achieve the freedom you deserve. Remember, the journey to financial independence won't happen overnight, but with persistence and determination, you can make it happen.

We'd love to hear from you! Share your thoughts on the debt-free nurse movement in the comments below or reach out to us on social media. Together, we can create a community of financially empowered nurses. Stay strong, stay focused, and keep crushing those debts!

Table of Contents

- Debt-Free Nurse Reviews: A Comprehensive Guide to Financial Freedom for Nurses

- What is the Debt-Free Nurse Movement?

- Why Should Nurses Care About Debt-Free Living?

- Top Debt-Free Nurse Strategies

- Debt-Free Nurse Reviews: What Are People Saying?

- Common Challenges Faced by Nurses

- Debt-Free Nurse Resources and Tools

- Debt-Free Nurse Lifestyle: Tips for Success

- Debt-Free Nurse vs. Traditional Financial Advice

- How to Get Started with the Debt-Free Nurse Movement